Posts in Category: JDM

judgment and decision making, choice, heuristics

Chapter: How can decision models decide to not decide? Modeling suspension in fast-and-frugal trees (FFTs)

Hansjörg Neth, Jelena Meyer

How can decision models decide to not decide?

Modeling suspension in fast-and-frugal trees (FFTs)

Abstract

The phenomena of indecision and suspension loom large in both philosophy and psychology. Whereas psychology discusses related phenomena in practical tasks and mostly pathological terms, philosophy strives for conceptual clarification and emphasizes the ubiquity and variety of suspension.

In this chapter, we use fast-and-frugal trees (FFTs) as a drosophila model for developing a positive account of suspension in decision-making. Being designed for handling binary classification tasks, FFTs seem particularly ill-suited for accommodating a third stance. But by replacing one decision outcome by a do not know category or adding it as a third option, we can adapt and extend the FFT framework to explore the causes and consequences of suspension.

Considering the distributions of decision outcomes and contrasting the performance of alternative models in terms of cost-benefit trade-offs illustrates the power of this methodology. Overall, a model-based approach provides surprising insights into the functions and mechanisms of suspension and serves as a productive tool for thinking.

Keywords

-

fast-and-frugal trees (FFTs), judgment and decision making (JDM), heuristics, binary classification, cost-benefit trade-offs, indecision, computer modeling, philosophy, machine learning, suspension

Reference

- Neth, H., & Meyer, J. (2025). How can decision models decide to not decide? Modeling suspension in fast-and-frugal trees (FFTs). In V. Wagner & A. Zinke (Eds.), Suspension in epistemology and beyond (pp. 286–303). New York, NY: Routledge.

doi 10.4324/9781003474302-20

Related: FFTrees: An R toolbox to create, visualize, and evaluate FFTs

Resources: 10.4324/9781003474302-20 | Download PDF | Google Scholar

Article: Heuristics — Tools for an uncertain world

to treat everything as if it were a nail.

Abraham H. Maslow (1966, p. 15f.)

Hansjörg Neth, Gerd Gigerenzer

Heuristics: Tools for an uncertain world

We distinguish between situations of risk, where all options, consequences, and probabilities are known, and situations of uncertainty, where they are not. Probability theory and statistics are the best tools for deciding under risk but not under uncertainty, which characterizes most relevant problems that humans have to solve. Uncertainty requires simple heuristics that are robust rather than optimal.

Paper: Heuristics for financial regulation

was very similar to one in which there was perfect information.

J. E. Stiglitz (2010). Freefall: America, free markets,

and the sinking of the world economy, p. 243

Hansjörg Neth, Björn Meder, Amit Kothiyal, Gerd Gigerenzer

Homo heuristicus in the financial world: From risk management to managing uncertainty

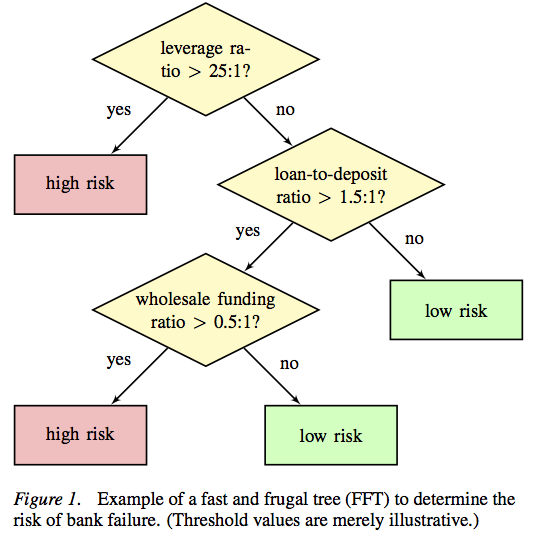

Abstract: What — if anything — can psychology and decision science contribute to risk management in financial institutions? The turmoils of recent economic crises undermine the assumptions of classical economic models and threaten to dethrone Homo oeconomicus, who aims to make decisions by weighing and integrating all available information. But rather than proposing to replace the rational actor model with some notion of biased, fundamentally flawed and irrational agents, we advocate the alternative notion of Homo heuristicus, who uses simple, but ecologically rational strategies to make sound and robust decisions. Based on the conceptual distinction between risky and uncertain environments this paper presents theoretical and empirical evidence that boundedly rational agents prefer simple heuristics over more flexible models. We provide examples of successful heuristics, explain when and why heuristics work well, and illustrate these insights with a fast and frugal decision tree that helps to identify fragile banks. We conclude that all members of the financial community will benefit from simpler and more transparent products and regulations.

Paper: Melioration as rational choice

Melioration (…) is the dynamic process controlling allocation of time across response alternatives.

Herrnstein & Vaughan (1980). Melioration and behavioral allocation, p. 143+172

Chris R. Sims, Hansjörg Neth, Robert A. Jacobs, Wayne D. Gray

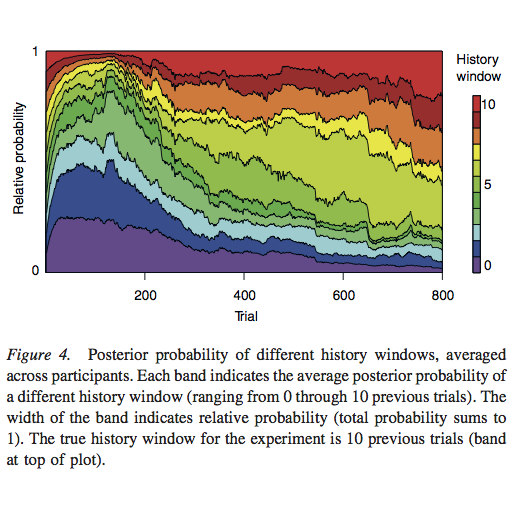

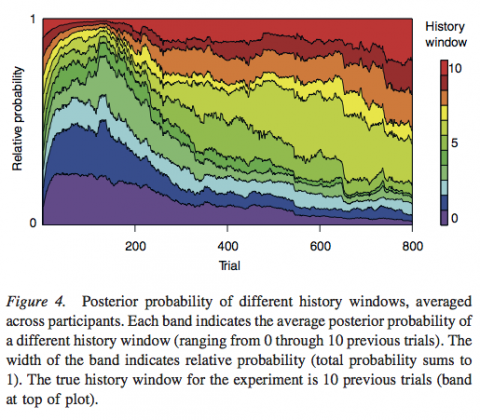

Melioration as rational choice: Sequential decision making in uncertain environments

Abstract: Melioration — defined as choosing a lesser, local gain over a greater longer term gain — is a behavioral tendency that people and pigeons share. As such, the empirical occurrence of meliorating behavior has frequently been interpreted as evidence that the mechanisms of human choice violate the norms of economic rationality. In some environments, the relationship between actions and outcomes is known. In this case, the rationality of choice behavior can be evaluated in terms of how successfully it maximizes utility given knowledge of the environmental contingencies. In most complex environments, however, the relationship between actions and future outcomes is uncertain and must be learned from experience. When the difficulty of this learning challenge is taken into account, it is not evident that melioration represents suboptimal choice behavior.