Posts in Category: psychology

the study of (mostly human) sensation & perception, cognition (learning, knowledge representation, thinking & reasoning) and behavior (action, judgment, choice & decision making, expertise and skilled performance)

Paper: Foraging for alternative options

If I go there will be trouble,

and if I stay it will be double…

The Clash

Hansjörg Neth, Neele Engelmann, Ralf Mayrhofer

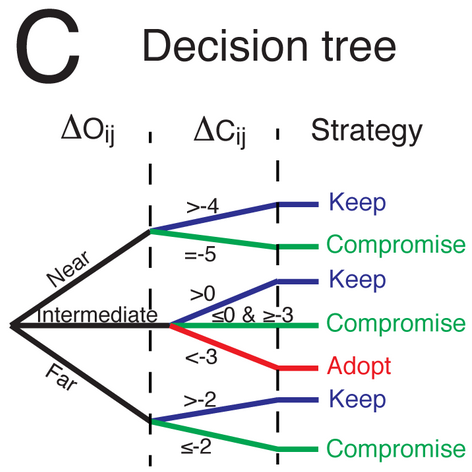

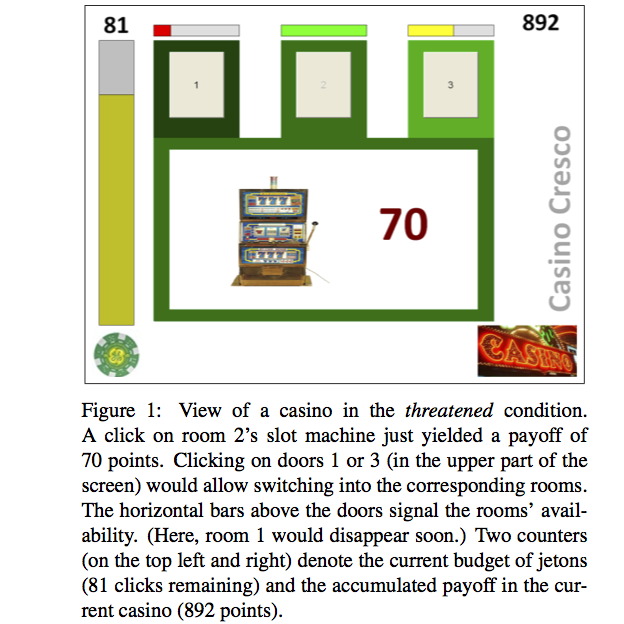

Foraging for alternatives: Ecological rationality in keeping options viable

Abstract: Do we invest irrational amounts of effort into keeping options viable, or do we manage available and threatened options in an adaptive fashion?

Paper: Heuristics for financial regulation

was very similar to one in which there was perfect information.

J. E. Stiglitz (2010). Freefall: America, free markets,

and the sinking of the world economy, p. 243

Hansjörg Neth, Björn Meder, Amit Kothiyal, Gerd Gigerenzer

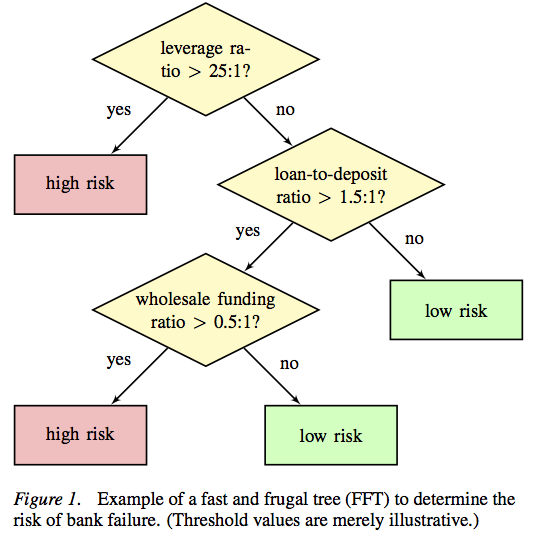

Homo heuristicus in the financial world: From risk management to managing uncertainty

Abstract: What — if anything — can psychology and decision science contribute to risk management in financial institutions? The turmoils of recent economic crises undermine the assumptions of classical economic models and threaten to dethrone Homo oeconomicus, who aims to make decisions by weighing and integrating all available information. But rather than proposing to replace the rational actor model with some notion of biased, fundamentally flawed and irrational agents, we advocate the alternative notion of Homo heuristicus, who uses simple, but ecologically rational strategies to make sound and robust decisions. Based on the conceptual distinction between risky and uncertain environments this paper presents theoretical and empirical evidence that boundedly rational agents prefer simple heuristics over more flexible models. We provide examples of successful heuristics, explain when and why heuristics work well, and illustrate these insights with a fast and frugal decision tree that helps to identify fragile banks. We conclude that all members of the financial community will benefit from simpler and more transparent products and regulations.

Paper: Melioration as rational choice

Melioration (…) is the dynamic process controlling allocation of time across response alternatives.

Herrnstein & Vaughan (1980). Melioration and behavioral allocation, p. 143+172

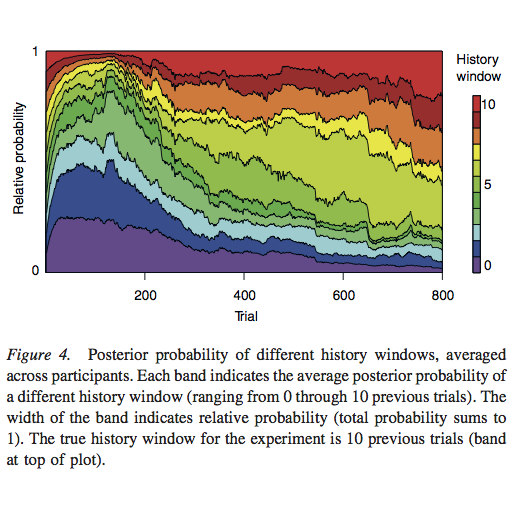

Chris R. Sims, Hansjörg Neth, Robert A. Jacobs, Wayne D. Gray

Melioration as rational choice: Sequential decision making in uncertain environments

Abstract: Melioration — defined as choosing a lesser, local gain over a greater longer term gain — is a behavioral tendency that people and pigeons share. As such, the empirical occurrence of meliorating behavior has frequently been interpreted as evidence that the mechanisms of human choice violate the norms of economic rationality. In some environments, the relationship between actions and outcomes is known. In this case, the rationality of choice behavior can be evaluated in terms of how successfully it maximizes utility given knowledge of the environmental contingencies. In most complex environments, however, the relationship between actions and future outcomes is uncertain and must be learned from experience. When the difficulty of this learning challenge is taken into account, it is not evident that melioration represents suboptimal choice behavior.