Posts in Category: methodology

methodology

Paper: Rational task analysis (RTA)

a theory of thinking and problem solving cannot predict behavior

unless it encompasses both an analysis of the structure of task environments

and an analysis of the limits of rational adaptation to task requirements.

(Newell & Simon, 1972, p. 55)

Hansjörg Neth, Chris R. Sims, Wayne D. Gray

Rational task analysis: A methodology to benchmark bounded rationality

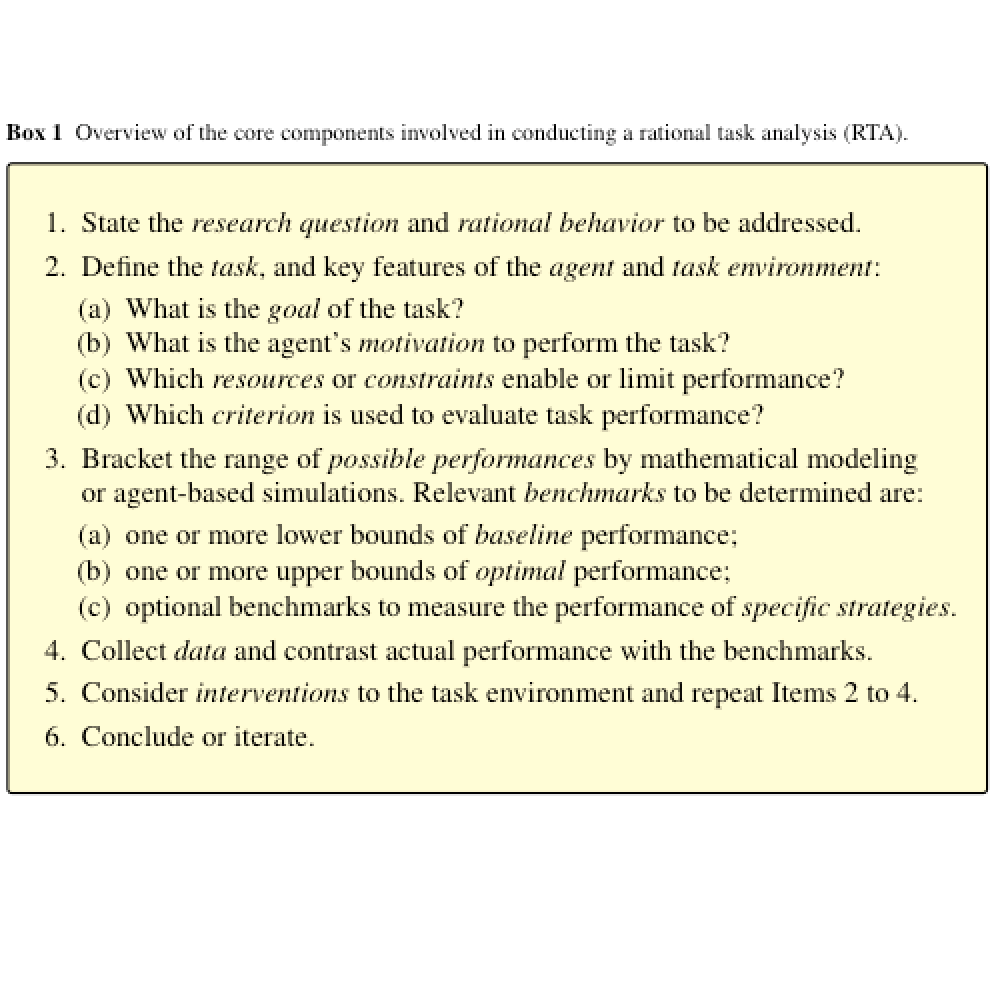

Abstract: How can we study bounded rationality? We answer this question by proposing rational task analysis (RTA)—a systematic approach that prevents experimental researchers from drawing premature conclusions regarding the (ir-)rationality of agents. RTA is a methodology and perspective that is anchored in the notion of bounded rationality and aids in the unbiased interpretation of results and the design of more conclusive experimental paradigms.

Paper: Foraging for alternative options

If I go there will be trouble,

and if I stay it will be double…

The Clash

Hansjörg Neth, Neele Engelmann, Ralf Mayrhofer

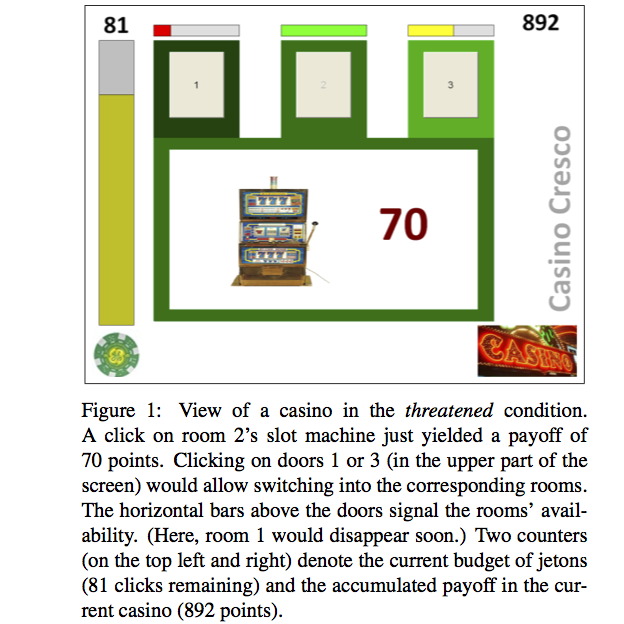

Foraging for alternatives: Ecological rationality in keeping options viable

Abstract: Do we invest irrational amounts of effort into keeping options viable, or do we manage available and threatened options in an adaptive fashion?

Artikel: Warum Controller auf Heuristiken setzen sollten

Hansjörg Neth

Warum Controller auf Heuristiken setzen sollten

Abstract: Datenintensive und immer detailliertere Analysen sind nicht immer die richtige Antwort auf die zunehmende Komplexität in der Unternehmenssteuerung. Unter Unsicherheit sind einfache Heuristiken, nach denen wir Informationen selektieren oder ignorieren, oft zielführender. Der mündige Controller verharrt nicht in den rationalen Reflexen des Homo oeconomicus. Er entstammt der Spezies des Homo heuristicus.

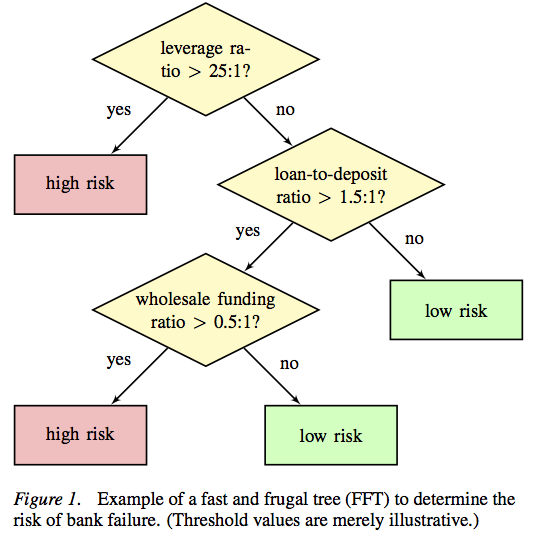

Paper: Heuristics for financial regulation

was very similar to one in which there was perfect information.

J. E. Stiglitz (2010). Freefall: America, free markets,

and the sinking of the world economy, p. 243

Hansjörg Neth, Björn Meder, Amit Kothiyal, Gerd Gigerenzer

Homo heuristicus in the financial world: From risk management to managing uncertainty

Abstract: What — if anything — can psychology and decision science contribute to risk management in financial institutions? The turmoils of recent economic crises undermine the assumptions of classical economic models and threaten to dethrone Homo oeconomicus, who aims to make decisions by weighing and integrating all available information. But rather than proposing to replace the rational actor model with some notion of biased, fundamentally flawed and irrational agents, we advocate the alternative notion of Homo heuristicus, who uses simple, but ecologically rational strategies to make sound and robust decisions. Based on the conceptual distinction between risky and uncertain environments this paper presents theoretical and empirical evidence that boundedly rational agents prefer simple heuristics over more flexible models. We provide examples of successful heuristics, explain when and why heuristics work well, and illustrate these insights with a fast and frugal decision tree that helps to identify fragile banks. We conclude that all members of the financial community will benefit from simpler and more transparent products and regulations.