Posts Tagged: applied

applied research

Artikel: Warum Controller auf Heuristiken setzen sollten

Hansjörg Neth

Warum Controller auf Heuristiken setzen sollten

Abstract: Datenintensive und immer detailliertere Analysen sind nicht immer die richtige Antwort auf die zunehmende Komplexität in der Unternehmenssteuerung. Unter Unsicherheit sind einfache Heuristiken, nach denen wir Informationen selektieren oder ignorieren, oft zielführender. Der mündige Controller verharrt nicht in den rationalen Reflexen des Homo oeconomicus. Er entstammt der Spezies des Homo heuristicus.

Kapitel: Das Potenzial einfacher Heuristiken in Controlling und Management Reporting

Hansjörg Neth

Wenn weniger mehr ist: Das Potenzial einfacher Heuristiken in Controlling und Management Reporting

Zusammenfassung:

- Controller sammeln Daten, berechnen präzise Kennzahlen und bereiten in Berichten möglichst viele Informationen sehr gewissenhaft auf – und verfehlen ihren Auftrag vielleicht gerade dadurch. Der Versuch, stets alle verfügbaren Daten zu berücksichtigen und in Entscheidungen einfliessen zu lassen, entspricht dem klassischen Ideal des Homo oeconomicus.

- Diese gründliche Vorgehensweise wurde für eine Welt des Risikos entwickelt, wird aber unkritisch auf Entscheidungen unter Unsicherheit übertragen. Zudem eignet sie sich eher zur Erklärung der Vergangenheit, soll in der Praxis aber Vorhersagen für die Zukunft liefern.

- Homo heuristicus stellt einen modernen Gegenentwurf zum Homo oeconomicus dar. Er nutzt einfache Heuristiken, die Informationen selektieren und ignorieren um robuste Vorhersagen unter Unsicherheit zu ermöglichen.

- Ein guter Bericht muss Prozesse transparent machen und nützliche Kennzahlen sollten den Weg weisen, anstatt nur Ergebnisvariablen abzubilden. Statt defensivem Entscheiden brauchen Unternehmen eine Fehlerkultur, in der man aus Fehlern lernen kann.

- Die Analyse von Heuristiken zeigt, wann und warum man sich auf seine Instinkte und Intuitionen verlassen kann und soll. In allen Bereichen, in denen Erfahrung eine Rolle spielt, wäre es unklug und fahrlässig, das Bauchgefühl von Experten geringer einzuschätzen als betriebliche Kennzahlen und statistische Zahlenkolonnen.

Paper: Heuristics for financial regulation

was very similar to one in which there was perfect information.

J. E. Stiglitz (2010). Freefall: America, free markets,

and the sinking of the world economy, p. 243

Hansjörg Neth, Björn Meder, Amit Kothiyal, Gerd Gigerenzer

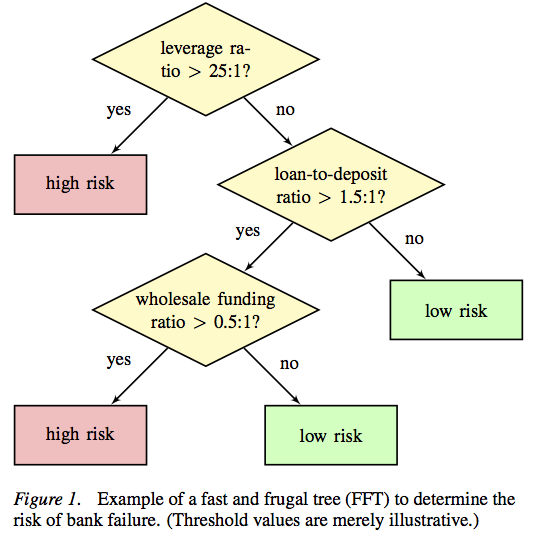

Homo heuristicus in the financial world: From risk management to managing uncertainty

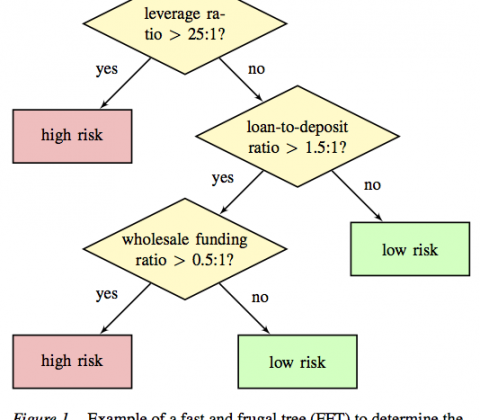

Abstract: What — if anything — can psychology and decision science contribute to risk management in financial institutions? The turmoils of recent economic crises undermine the assumptions of classical economic models and threaten to dethrone Homo oeconomicus, who aims to make decisions by weighing and integrating all available information. But rather than proposing to replace the rational actor model with some notion of biased, fundamentally flawed and irrational agents, we advocate the alternative notion of Homo heuristicus, who uses simple, but ecologically rational strategies to make sound and robust decisions. Based on the conceptual distinction between risky and uncertain environments this paper presents theoretical and empirical evidence that boundedly rational agents prefer simple heuristics over more flexible models. We provide examples of successful heuristics, explain when and why heuristics work well, and illustrate these insights with a fast and frugal decision tree that helps to identify fragile banks. We conclude that all members of the financial community will benefit from simpler and more transparent products and regulations.

Paper: Ranking LOD data with a cognitive heuristic

Arjon Buikstra, Hansjörg Neth, Lael J. Schooler, Annette ten Teije, Frank van Harmelen

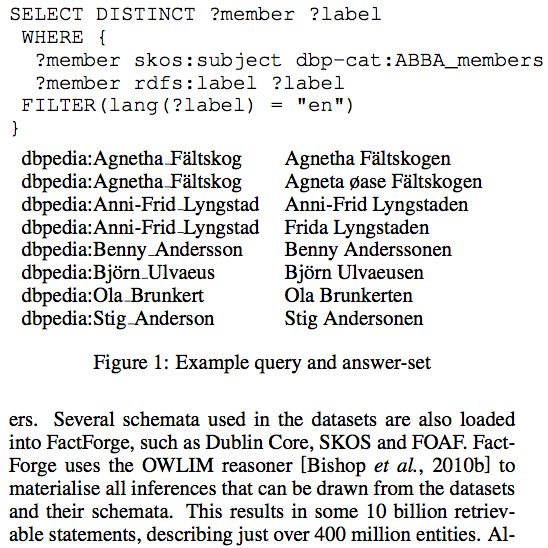

Ranking query results from Linked Open Data using a simple cognitive heuristic

Abstract: We address the problem how to select the correct answers to a query from among the partially incorrect answer sets that result from querying the Web of Data.